Digital Gold 16175.94/gm +GST GOLD LOAN AT 0.85% Per Month 24K GOLD COIN 16890.3/gm +GST Digital Gold 16175.94/gm +GST GOLD LOAN AT 0.85% Per Month 24K GOLD COIN 16890.3/gm +GST

Digital Gold 16175.94/gm +GST GOLD LOAN AT 0.85% Per Month 24K GOLD COIN 16890.3/gm +GST

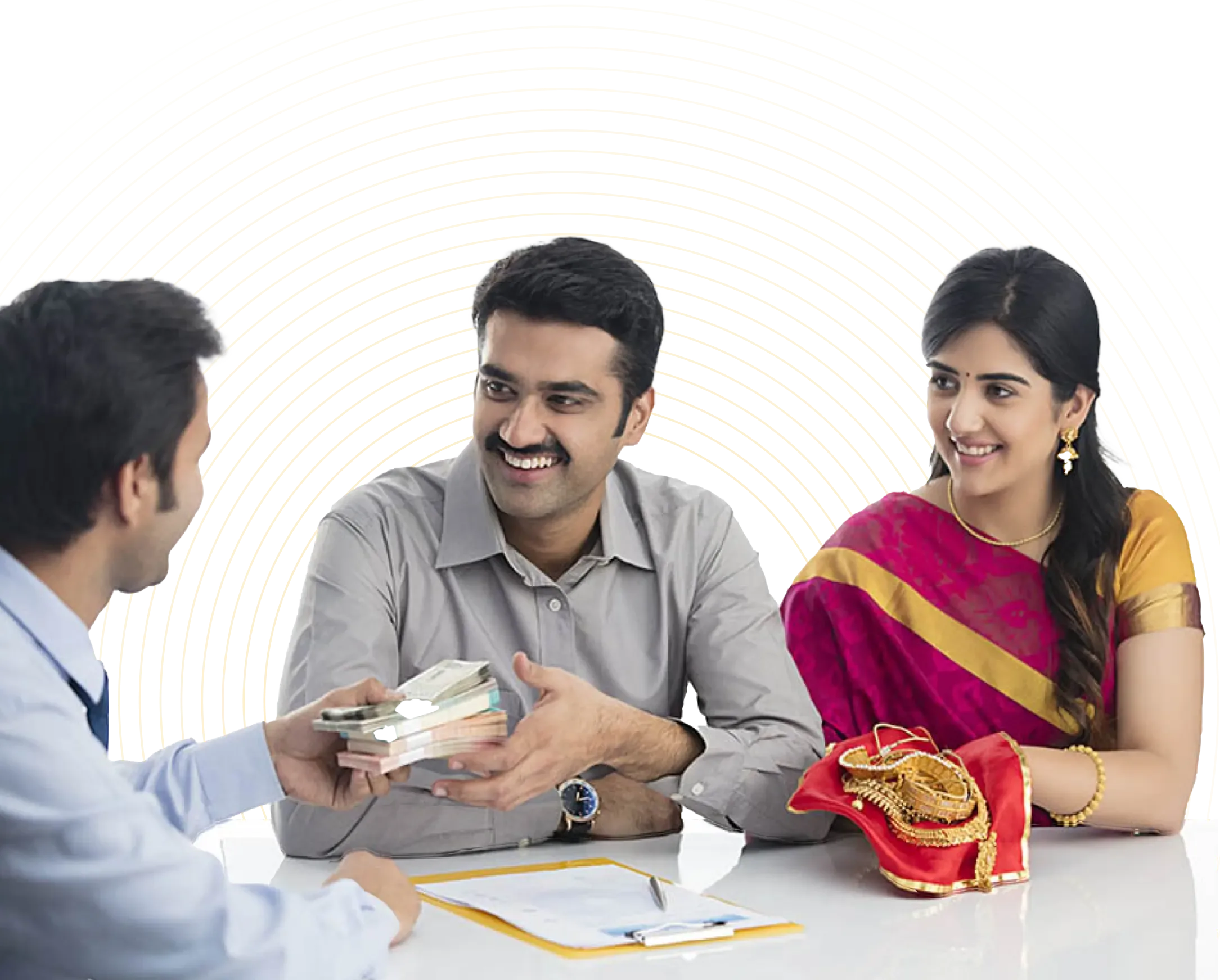

Gold Loan Calculator

A Gold loan calculator is a tool used to estimate the amount of money that can be borrowed against gold jewellery or ornaments. Also find out Gold Loan EMI with the help of this gold loan calculator.

STEP 1

Enter gold weight

grams

GET MAXIMUM VALUE

Get money quickly in your account

Check the value of your gold and claim your cash now!