Digital Gold 13803.34/gm +GST GOLD LOAN AT 0.85% Per Month 24K GOLD COIN 14660.2/gm +GST Digital Gold 13803.34/gm +GST GOLD LOAN AT 0.85% Per Month 24K GOLD COIN 14660.2/gm +GST

Digital Gold 13803.34/gm +GST GOLD LOAN AT 0.85% Per Month 24K GOLD COIN 14660.2/gm +GST

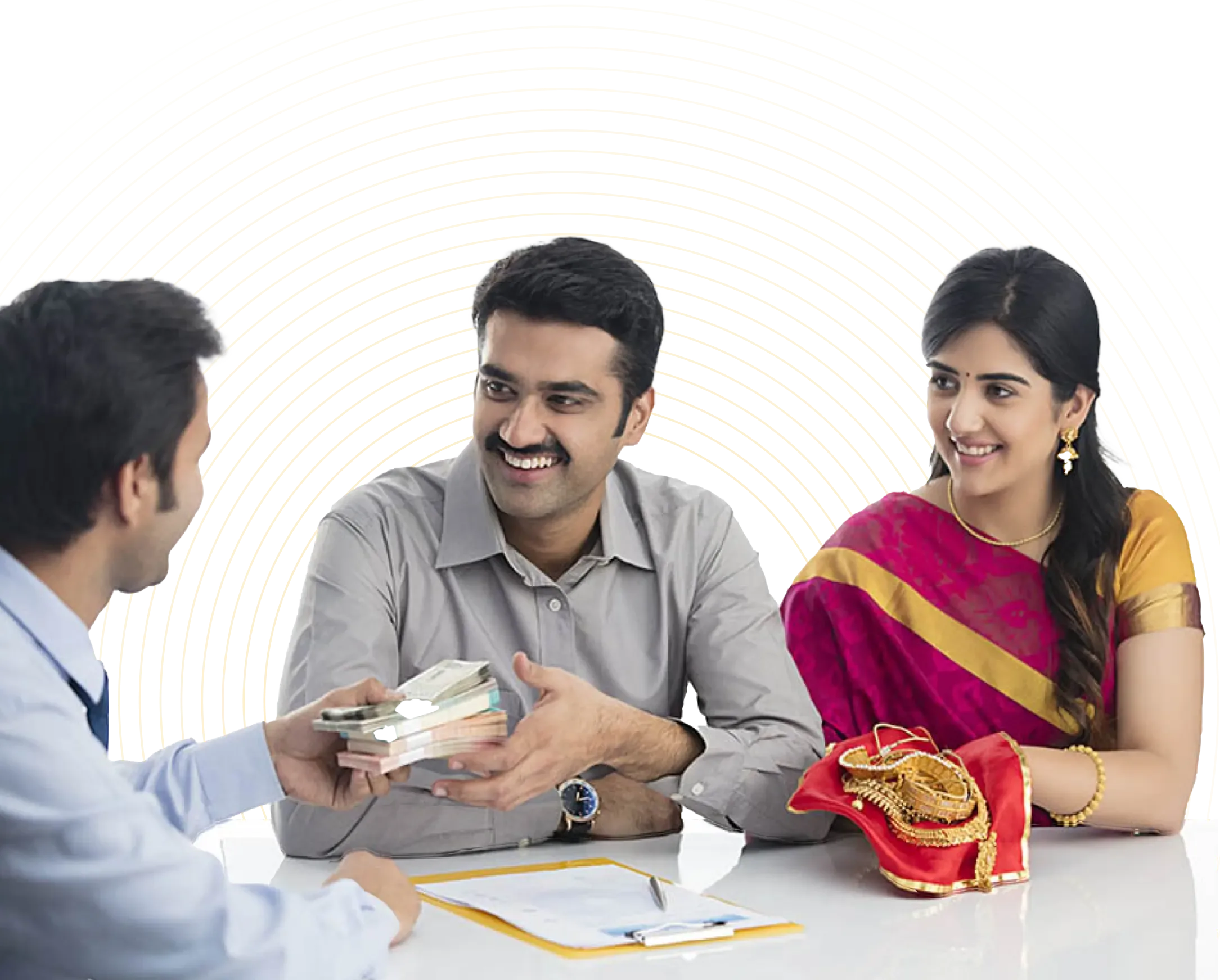

Get Instant Gold Loan

in Mumbai at Just

@0.85% per month*

Avail gold loans in Mumbai at the best per gram rates. Quick disbursal, highest ROI, and minimal paperwork!

Enter Your Mobile Number to Get a Callback

Visit Our Nearest Office in Mumbai:

Building A-109, Sagar Tech Plaza, Andheri Kurla Road, Sakinaka Junction, Mumbai, 400074

Visit Branch

Apply with mobile number

You will receive a call from our Relationship Manager

Visit Our Nearest Office in Mumbai:

Building A-109, Sagar Tech Plaza, Andheri Kurla Road, Sakinaka Junction, Mumbai, 400074

Visit Branch

*Terms & Conditions apply

Gold Loan Calculator in Mumbai

STEP 1

Enter gold weight

grams

Gold Loan Calculator in Mumbai

STEP 1

Enter gold weight

grams

GET MAXIMUM VALUE

Get money quickly in your account

Check the value of your gold and claim your cash now!

WHAT IS SPECIAL ABOUT GOLD LOANS?

Gold loans are bullet facilities - you need to pay back principal at end of tenure.

0.85% RATE OF INTEREST PER MONTH

GOLD LOAN

MONEY TRANSFER IN JUST 30 MINUTES

100% FREE INSURANCE ON YOUR GOLD