Digital Gold 14030.3/gm +GST GOLD LOAN AT 0.85% Per Month 24K GOLD COIN 13695.2/gm +GST Digital Gold 14030.3/gm +GST GOLD LOAN AT 0.85% Per Month 24K GOLD COIN 13695.2/gm +GST

Digital Gold 14030.3/gm +GST GOLD LOAN AT 0.85% Per Month 24K GOLD COIN 13695.2/gm +GST

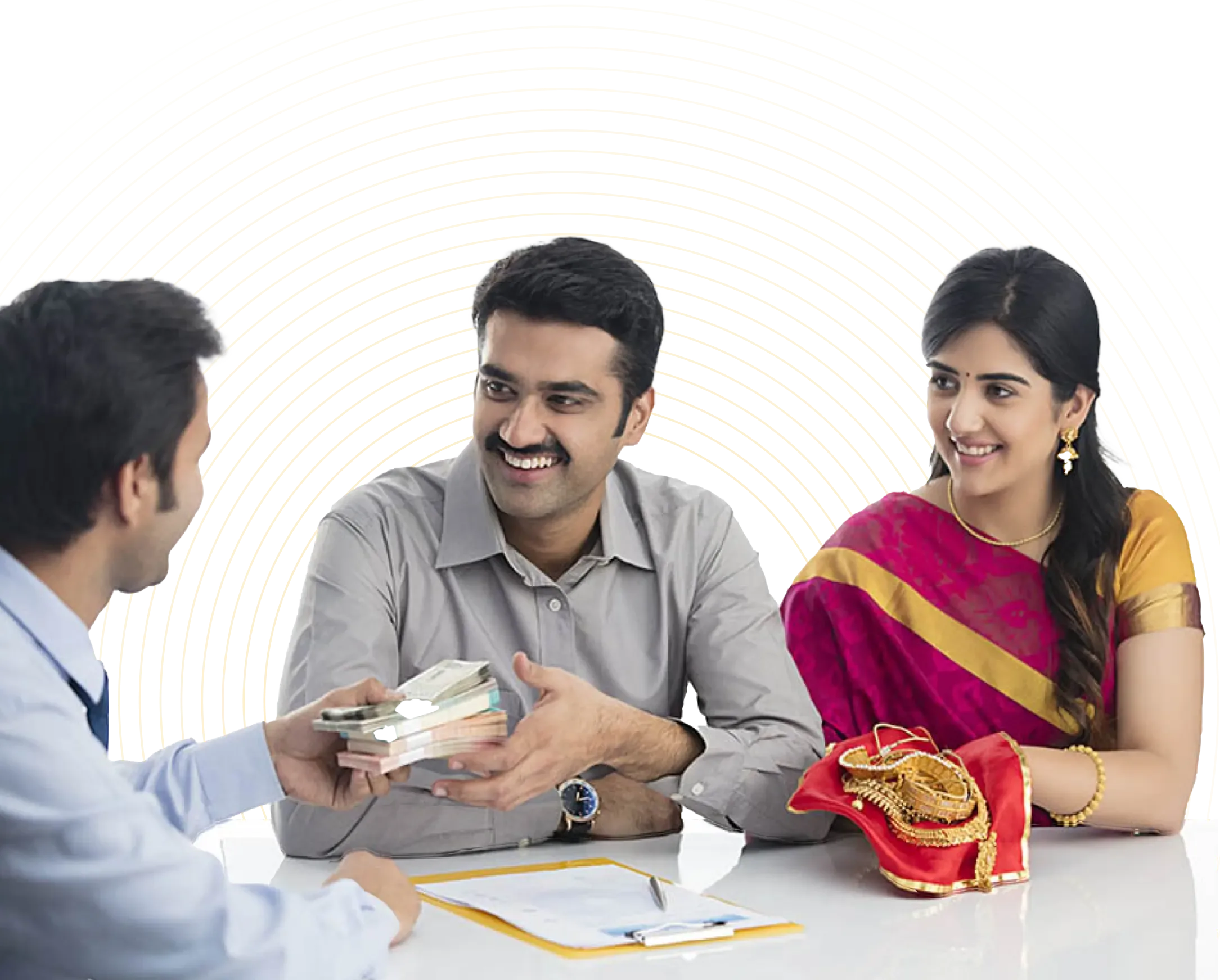

Get Instant Gold Loan

in Hyderabad at Just

@0.85% per month*

Avail gold loans in Hyderabad at the best per gram rates. Quick disbursal, highest ROI, and minimal paperwork!

Enter Your Mobile Number to Get a Callback

Visit Our Nearest Office in Hyderabad:

4th Floor, No. 6-3-853, 854/A/M/407, Meridian Plaza, Beside Lal Bungalow, Ameerpet, Hyderabad, Telangana, 500016

Visit Branch

Apply with mobile number

You will receive a call from our Relationship Manager

Visit Our Nearest Office in Hyderabad:

4th Floor, No. 6-3-853, 854/A/M/407, Meridian Plaza, Beside Lal Bungalow, Ameerpet, Hyderabad, Telangana, 500016

Visit Branch

*Terms & Conditions apply

Gold Loan Calculator in Hyderabad

STEP 1

Enter gold weight

grams

Gold Loan Calculator in Hyderabad

STEP 1

Enter gold weight

grams

GET MAXIMUM VALUE

Get money quickly in your account

Check the value of your gold and claim your cash now!

WHAT IS SPECIAL ABOUT GOLD LOANS?

Gold loans are bullet facilities - you need to pay back principal at end of tenure.

0.85% RATE OF INTEREST PER MONTH

GOLD LOAN

MONEY TRANSFER IN JUST 30 MINUTES

100% FREE INSURANCE ON YOUR GOLD