Gold Loan in Gurgaon @

0.8% per month*

Gold Loan in Gurgaon

@ 0.8% per month*

Gold Loan in Gurgaon @

0.8% per month*

Gold Loan in Gurgaon

@ 0.8% per month*

*Terms & Conditions apply

Gold Loan Calculator in Gurgaon

STEP 1

Enter gold weight

grams

Gold Loan Calculator in Gurgaon

STEP 1

Enter gold weight

grams

GET MAXIMUM VALUE

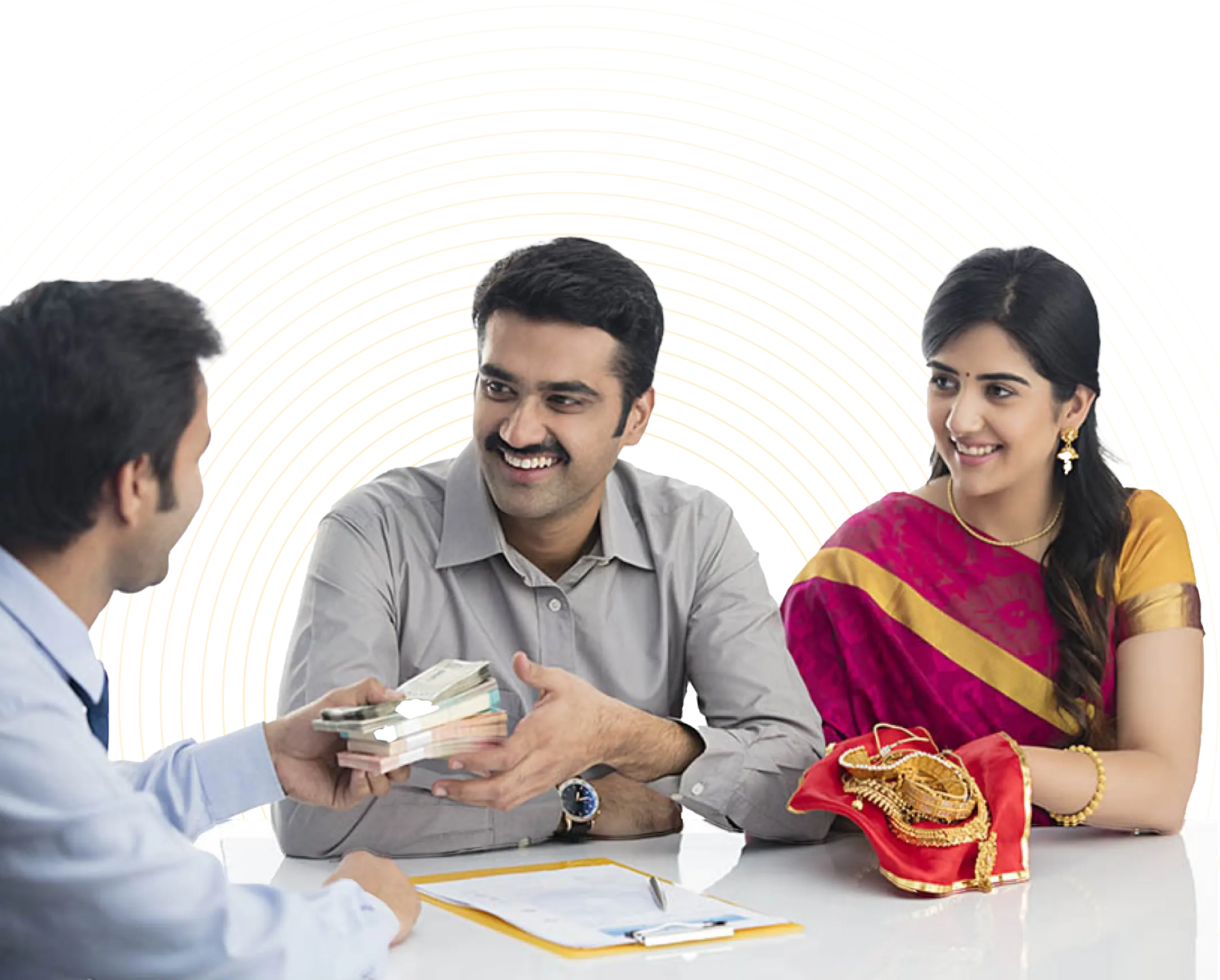

Get money instantly in your account

Check the value of your gold and claim your cash now!

WHAT IS SPECIAL ABOUT GOLD LOANS?

Gold loans are bullet facilities - you need to pay back principal at end of tenure.

0.8% RATE OF INTEREST PER MONTH

GOLD LOAN

MONEY TRANSFER IN JUST 30 MINUTES

100% FREE INSURANCE ON YOUR GOLD